Sites that compare auto insurance rates online are an excellent method to lower your premiums. However, which is considered the best?

One of the top websites for comparing vehicle insurance quotes is Insurancey, whose goal is to find novel ways to enable users to save money on desired purchases. Nobody enjoys shopping for auto insurance; let’s face it. But it doesn’t imply that looking for insurance can be simpler and less frustrating.

In the past, if you wanted to compare vehicle insurance rates, you had to contact or visit every insurance provider separately, spending hours in the queue. Thankfully, vehicle insurance comparison websites turn the hour-long procedure into a few minutes of work.

Luckily, one day I came to know about an online auto insurance comparison site called Insurancey, which helped me easily find the best insurance quotes. However, keep reading this content to understand why Insurancey is the best site to compare car insurance quotes and many more!

Insurancey: What You Need to Know

The most famous brand in terms of automobile comparison websites is Insurancey. This business asserts that it provides a quick and trustworthy approach to assessing local car insurance rates.

By providing you with real-time quotations, it seeks to make coverage simpler. Insurancey is a free auto insurance comparison website similar to other well-known websites. If you have car insurance questions in Arkansas, you can check Insurancey for your answers.

No matter where you reside, you can acquire insurance because the website works with more than 30 leading carriers and provides prices for all 50 states. The business began with vehicle insurance.

Using our internet insurance community, you may evaluate auto insurance plans offered by various firms.

The comparison website may also assist you in finding a great bargain on home, disability, and rental insurance in conjunction with vehicle insurance. Furthermore, Insurancey sends your information to the agent or firm after you’ve chosen one.

By distributing your data, the website facilitates a quicker and more efficient shopping procedure. Trustworthy auto insurance quote comparison websites, such as Insurancey, won’t sell your information to vehicle insurance companies or agencies, which is an essential point to remember.

The strong points of using Insurancey are the following:

- It lets you compare multi-insurance quotes.

- It demonstrates real-time and valid quotes for the users.

- It allies with America’s leading national and regional organizations.

In what ways does it surpass other sites?

These are some of the ways that Insurancey surpasses other sites:

- By allowing you to connect your existing insurance account, Insurancey eliminates the hassle of price comparison shopping.

- It is capable of doing an automated analysis of your policy to ascertain details on your insurance, vehicle, and policyholders.

- It is possible to look for an incredible deal from different insurance companies with comparable or greater coverage.

- Insurancey can provide you with prices for completely comprehensive auto insurance.

- Absolutely no spam at all.

- It works with many reputable, licensed motor insurers around the nation to help you locate premium coverage that meets your needs and finances.

How the Insurancey works?

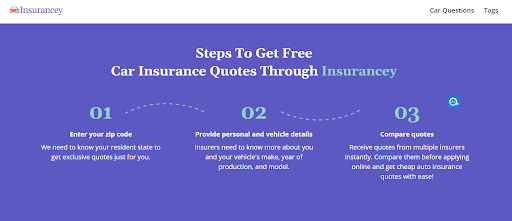

Your zip code must be entered before you can receive quotes from Insurancey. The next step will ask you to incorporate further details, including whether you have automobile insurance or own or lease your property.

The website then demands details regarding your car and its insurance background before questioning you about yourself and any other drivers that the insurance would cover. Registering an account and saving your data for future use is also available.

However, follow the steps below to obtain complementary auto insurance quotes through Insurancey:

Step 1: Visit Insurancey

Go to the official site of Insurancey.

Step 2: Provide the ZIP code of your location

Insurancey needs to understand your location in order to provide top-notch quotes tailored to you.

Step 3: Submit your personal and car details

As the insurers are willing to know more about your personal information and your car’s production year, model, manufacturing unit, and model, you need to provide all this information.

Step 4: Compare quotes

Once you have submitted your car and personal details, you will receive different quotes from several insurers within a few minutes. Therefore, you need to compare each of them precisely prior to applying online, and obtain budget-friendly auto insurance quotes easily.

What affects your quotes received from Insurancey?

- Your location

Due to varied restrictions, your state of residence has a significant role in determining the cost of your coverage.

- Your driving record

Your coverage charges will go up if you have an accident history on your driving record. Still, a ticket-free driving history may significantly lower your insurance costs in most circumstances.

- Where you keep your car

The place where the vehicle is parked in your neighborhood has a higher likelihood of burglary and accidents. As a result, customers purchasing auto insurance in urban areas must pay higher rates than those who live in rural areas.

- Your occupation

You will pay a greater rate for vehicle insurance if you have a lower income.

- Your education level

Higher-educated drivers with master’s and doctoral degrees pay the minimum amount for auto

insurance compared to less-educated drivers.

- The car you drive

A luxury sedan will have a higher insurance rate than a hatchback. This is due to the vehicle’s fundamental design.

- Your credit record

The duration of a person’s payment history, foreclosures, bankruptcies, and debt load are all taken into account when calculating their credit-based coverage ratings.

- Your demographic information

Due to the higher statistical likelihood of causing auto insurers to lose money, young male drivers represent the most costly group to cover.

Clients review of Insurancey

Some of the leading clients’ reviews are the following:

“As a school teacher, it might be challenging to arrange a time during the day to phone several insurance brokers. But Insurancey took care of everything to secure the best pricing for me after a quick signup process.”

“I have never used a vehicle insurance system as simple and convenient as this one. In addition to saving me $300 on my automobile insurance, the service was satisfactory to me. Thanks to Insurancey, I was able to save money!”

Final thoughts

You may view rates from multiple national insurance companies when you compare them online. Normally, you can compare options, view prices, and check insurance levels alongside, then sign up in only a few clicks.

You will not have to worry about skipping a deal, and you’ll save time and money. Insurancey’s quick response system lets you obtain quotes asap within a few hours, and everything will be executed online.